Sources of Product Learning and Exploiting Them

I’ve been talking with Product people around Asia...

Key Performance Indicators (KPIs) are important to business leaders as instruments on a cockpit to an aircraft pilots. It is tempting to go with the more are the better as each bring some value and perspective. Some KPIs can be considered critical but others are good to have. In this article we would like to clarify on the must have indicators for SaaS businesses.

Similar to aircraft indicators and their quantity correlates well with the size of the business. If your organisation is fairly small you are probably going to waste more time and resources if you decide to collect, measure and analyse more indicators than necessary for your stage of the business.

It is important to focus on those that fit your strategy and stage of your business development among other things.

In most cases SaaS companies would measure:

Active users – not always easy to measure but extremely beneficial to detect issues early and prevent churn. Active users can be those who are using your product daily, weekly or monthly, and depends on the type of the product and designed user experience. If your product is only used once per month for monthly reporting purposes it would be absolutely normal not to expect users to use it daily.

Churn – actual churn, it is tempting to exclude some types e.g. churn in the first month, differentiate voluntary or involuntary churn. Our advice is don’t overcomplicate and don’t move the goalposts during the game. Change it if absolutely need it, and make a note why did you decide to make that change, so you don’t go back and forth changing it often. Changing KPIs measurements likely indicates other issues, for example acquisition of the right type of customers (overselling), customer support quality or product usability.

Revenue – usually for SaaS companies it is Monthly Recurring Revenue (MRR) even if they provide Annual subscription option. For companies selling SaaS to large Enterprises it would likely be Annual Recurrent Revenue (ARR).

It is hard to imagine a SaaS company that would be able to live without the above three.

Any business that has several dozens of customers and operate over 1 year, need to measure Customer Acquisition Cost (CAC) followed by Cost To Serve (CTS).

Customer Acquisition Cost – would need to tell you how much does it cost you to bring one paying customer on average. You need to take all you Sales & Marketing costs (salaries, tools included) in the period of 3 or 12 months and divide it by the number of new customers at the same period.

Cost to Serve – would need to tell you how much does it cost you to serve your existing customers. This might make you think on how to make your customers to be more profitable to your business through upsell, cross-sell or maybe even identifying those who cost you more than you make and who might be too far from your ideal customer profile.

The above are the essential SaaS KPIs which you might want to measure and set goals accordingly.

Where it gets more tricky is to consider additional KPIs depending on the strategy of your business. If your customer acquisition is through Sales Lead Growth that we talked about in our other article, you might measure Average Deal Size (total revenue in the period, divided by the number of new customers acquired during the same period), and in sales operations you might also measure Pipeline coverage (all your sales deals in the pipeline divided by your revenue target goal).

If you company customer acquisition is through Product Led Growth then, measuring Cost Per Lead and Conversion Ratio from Lead to Customer might be more appropriate.

Your board of directors might ask for Year-over-Year Growth, Customer Lifetime Value (CLV), Magic Number, Revenue per Employee and many other metrics. One should still focus on the key metrics and consistency in measuring them to build business on solid foundations regardless of any other indicators.

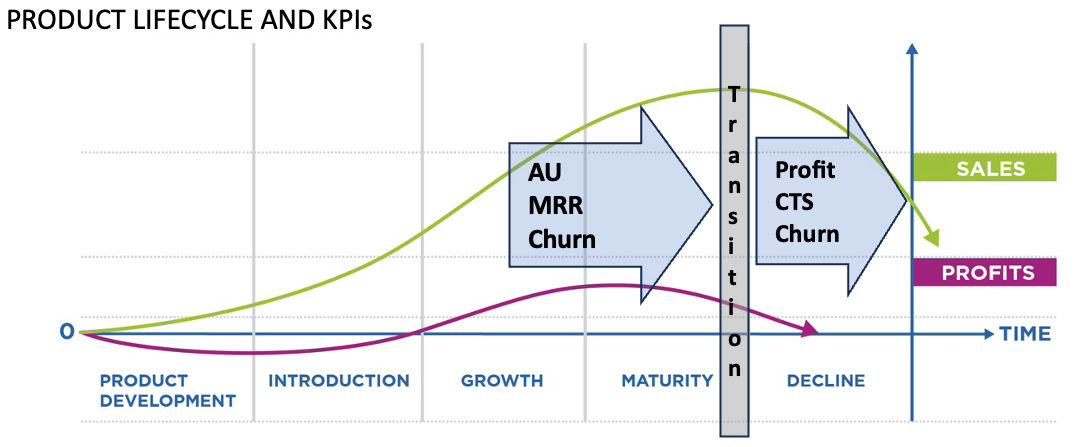

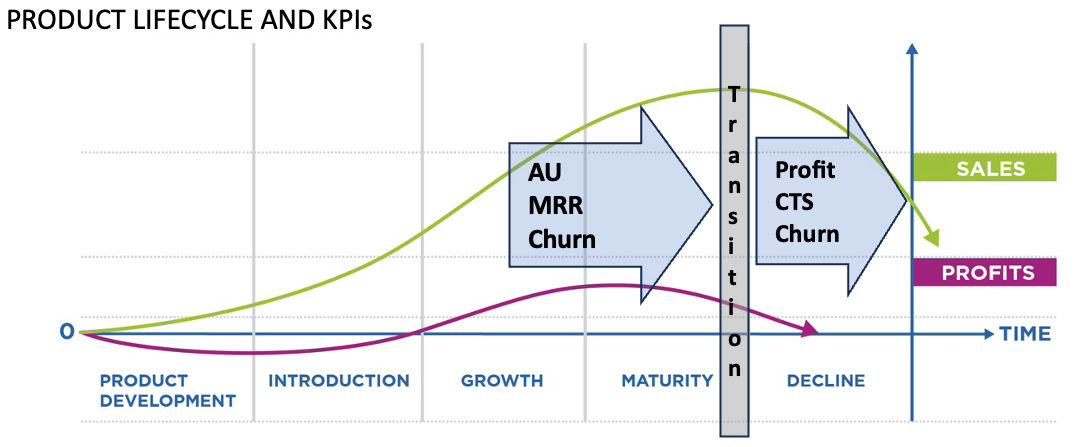

Mature organisations that operate for long period of time and those with multiple products in their portfolio would likely apply different KPIs to different products and business units.

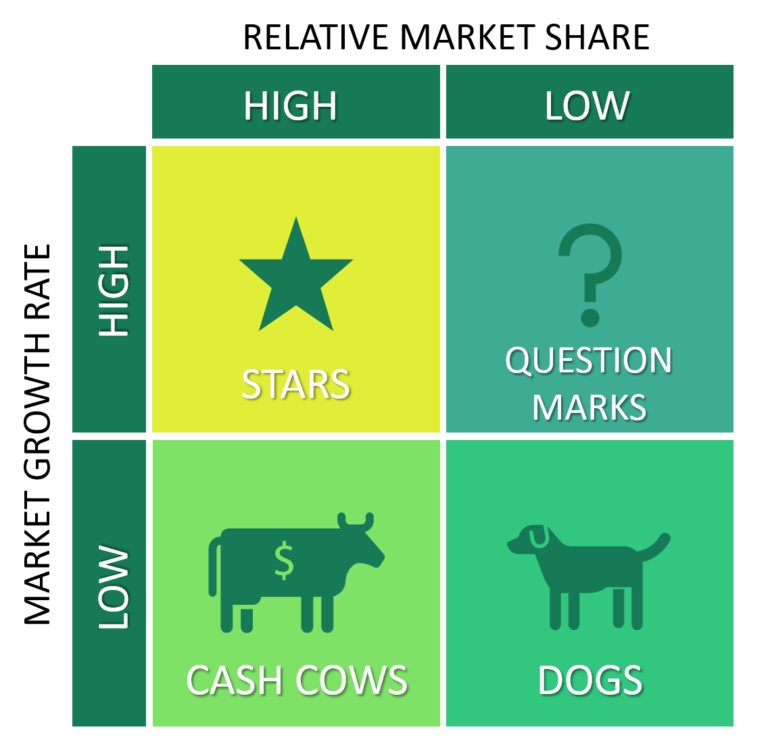

We would also like to look into applications of different KPIs for products and organisations at their stage of maturity or growth and market share position. If you would like to know more about this popular model, one can search for BCG growth market share model.

In short, any product can be placed in one of the respective quadrants and change its position through the time as product mature.

So, it is important to change KPIs when such position changes. For example a product at its early days is likely to start as a “Dog” with low market share and low market growth and through a series of iterations/releases can get closer to a Product Market Fit (PMF) with still low market share but much higher growth rate.

Such, change will likely to be noticed through a measurement of:

At that point you would benefit to measure “Voice of Customer”, how often your product or company mentioned in media in relevance to your competitors. Such metric would provide higher value to you in decision making before Market Share research.

At the same time if one of your products is not growing for a long time, total addressable market is shrinking or you decided to end its life in the future, it might be best to focus on measuring Profitability from such product, starting with clear attribution of Cost to Serve figures to this specific product.

During the product maturity phase it would be worth considering to change the order of KPIs from Active Users, MRR, Churn to Profit, Cost to Serve, Churn.

Measuring the right KPIs at the right time and phase of product maturity in a SaaS business is both an art and a science.”

As companies evolve and products transition through stages, the relevance of certain KPIs changes. It’s crucial to adjust and refine these metrics accordingly. From the initial focus on active users, churn rates, and revenue models to the strategic alignment of KPIs based on growth strategies, the journey is about adapting measurements to suit the company’s trajectory. For instance, transitioning from tracking market share to assessing the “Voice of Customer” during phases of market positioning evolution is pivotal.

Ultimately, the key lies in continuously evaluating and adjusting KPIs to mirror the changing landscape of the business.

Written by