What Product Organisations in Asia are Doing Well

Over the past few months, I have conducted...

In-product feedback can be a powerful source of user insight, yet – we don’t see it being collected often enough by product teams. When used appropriately it can be an important complement to user analytics providing qualitative nuance to what is observed by click tracking and session recordings. There are three types of in product feedback that you can leverage. Let’s review each one in turn.

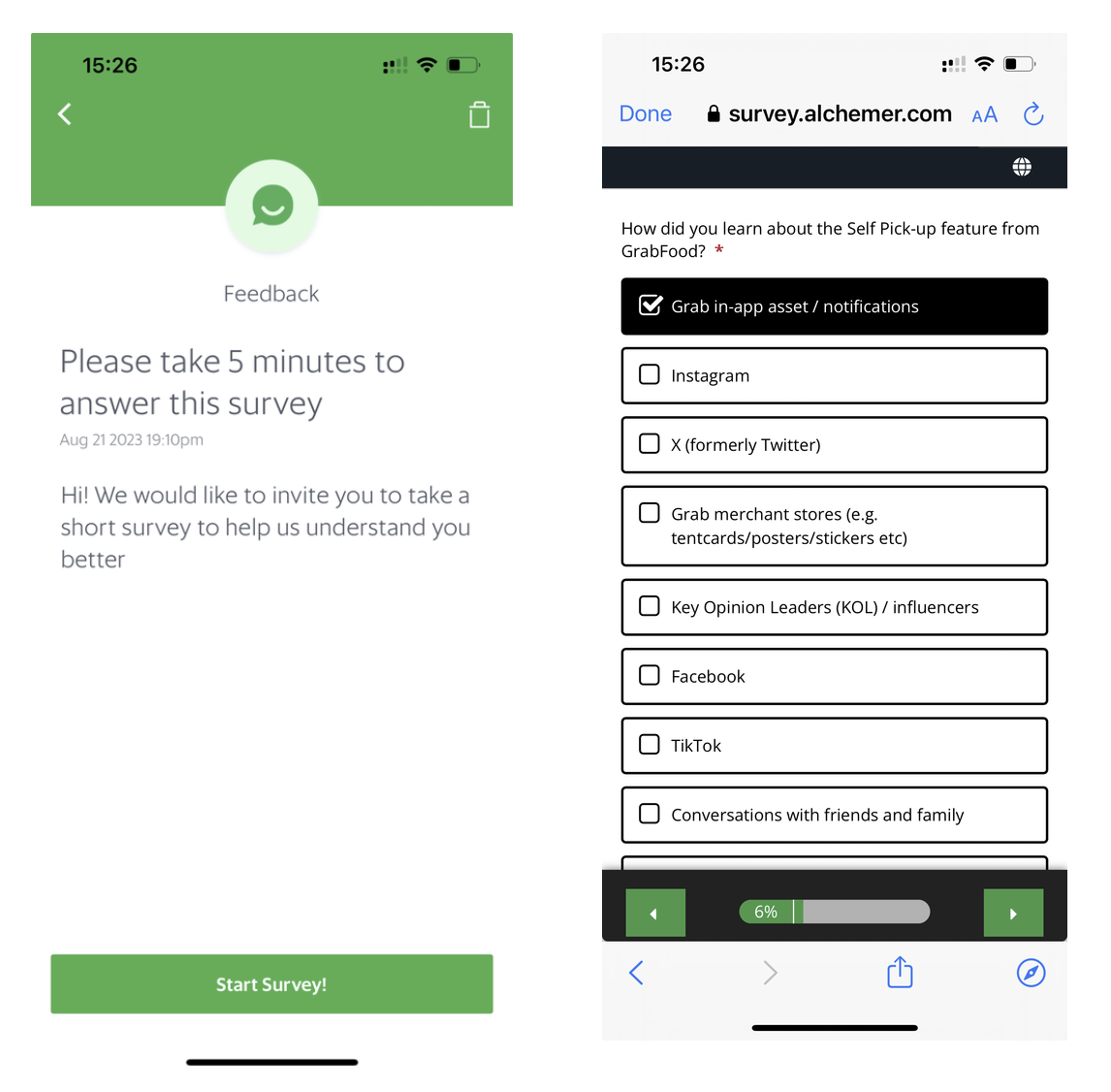

Perhaps the most common type of in-product feedback collection is inviting users to complete a survey. It is a convenient, cheap and effective way to reach your users and run surveys. Commonly seen in consumer apps – particularly ecommerce apps at the end of the checkout process. Works best when you have a significant number of daily active users and want to collect as many responses as possible.

The surveys are best used when you prompt users at the end of their task or transaction and ask them to fill out a survey. Be careful to not interrupt them in their goals to be using your product at that point in time. A big benefit of this survey method is the ability to segment and target the users based on your knowledge of their user behaviours and patterns. This gives you rich dimensions with which you can analyse the results of the survey.

In many ways, when doing general surveys, you are not taking much advantage of the product as a collection method. Most of these types of surveys could have been, delivered via other channels. For example, email. Collecting feedback through your product can be more actionable. Especially when you are tying in the survey experience with your in-product experience.

One way to make feedback collection an integral part of the user experience is to embed opportunities for feedback in the user journey.

A common example is a cancellation survey for subscription based products. Here the survey is typically made part of the cancellation process with mandatory fields / steps for the user to actually be able to complete the action. An extreme approach! This, potentially annoys users that want to just cancel the service and could pollute the results with poorer answer. But given that the users is on its way out anyway, maybe a mild irritant for the user is worth it for one last opportunity to learn as much as possible!

But cancellation is not the only point where you can ask users “why” and prompt them for feedback. You can map out critical steps in the experience lifecycle and introduce quick questionnaires and prompts: when users finishes onboarding, when users completes an activation step (i.e. when they have reached the aha moment of your product), when users give up on a task, etc.

In all of these, the key is to not interrupt the user in their experience, and keep the questions short and hyper relevant to the task they have completed. Be sure to correlate results from these feedback points with user analytics, measuring potentially adverse effect of introducing these prompts, and linking responses with measured and observed behaviours.

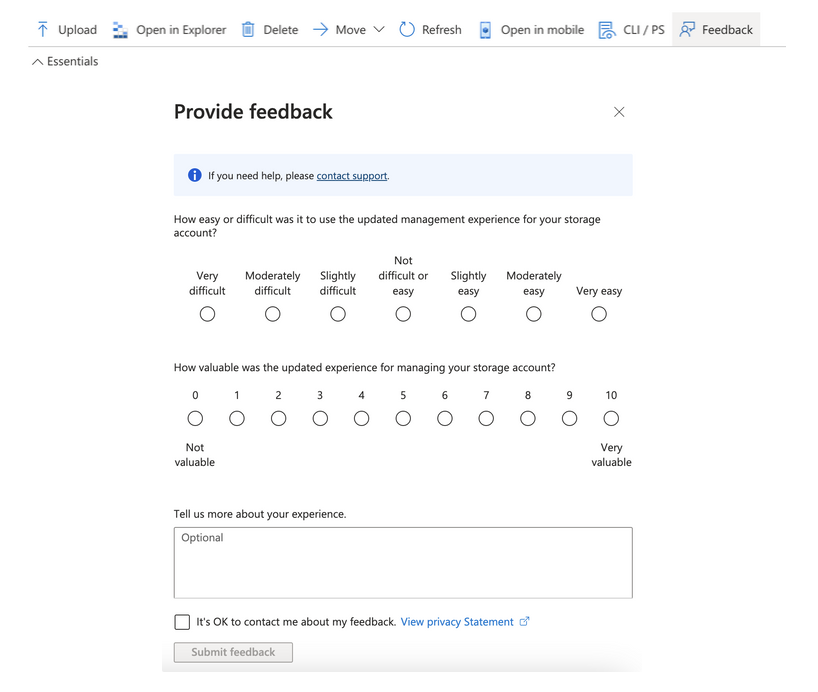

Lastly, you can embed opportunities for open ended feedback throughout your product with “Feedback” buttons. Certainly, feedback collected in this way can be quite biased – with user participating mostly out of frustration with the product. However, if one user is frustrated enough, it might be the tip of the iceberg and will give you hints on where to look in your session analysis or user analytics. Be sure to have a robust process to follow up with analytics on feedback collected in this way and a process to reach out to users and find more about their struggles.

In all cases, users that respond to your collection prompts in your product are users that are open and willing to engage with you and give you feedback – they represent a source of users that you can tap into for more insight, so be sure to ask if they would be willing to participate in a short call / interview where you can go in-depth into their needs. These users are in fact “leads” for your user research – treat them as such, follow up and take the chance to learn more from them. At the end of the survey in the product ask them if they would like to be contacted or participate in further research.

Written by